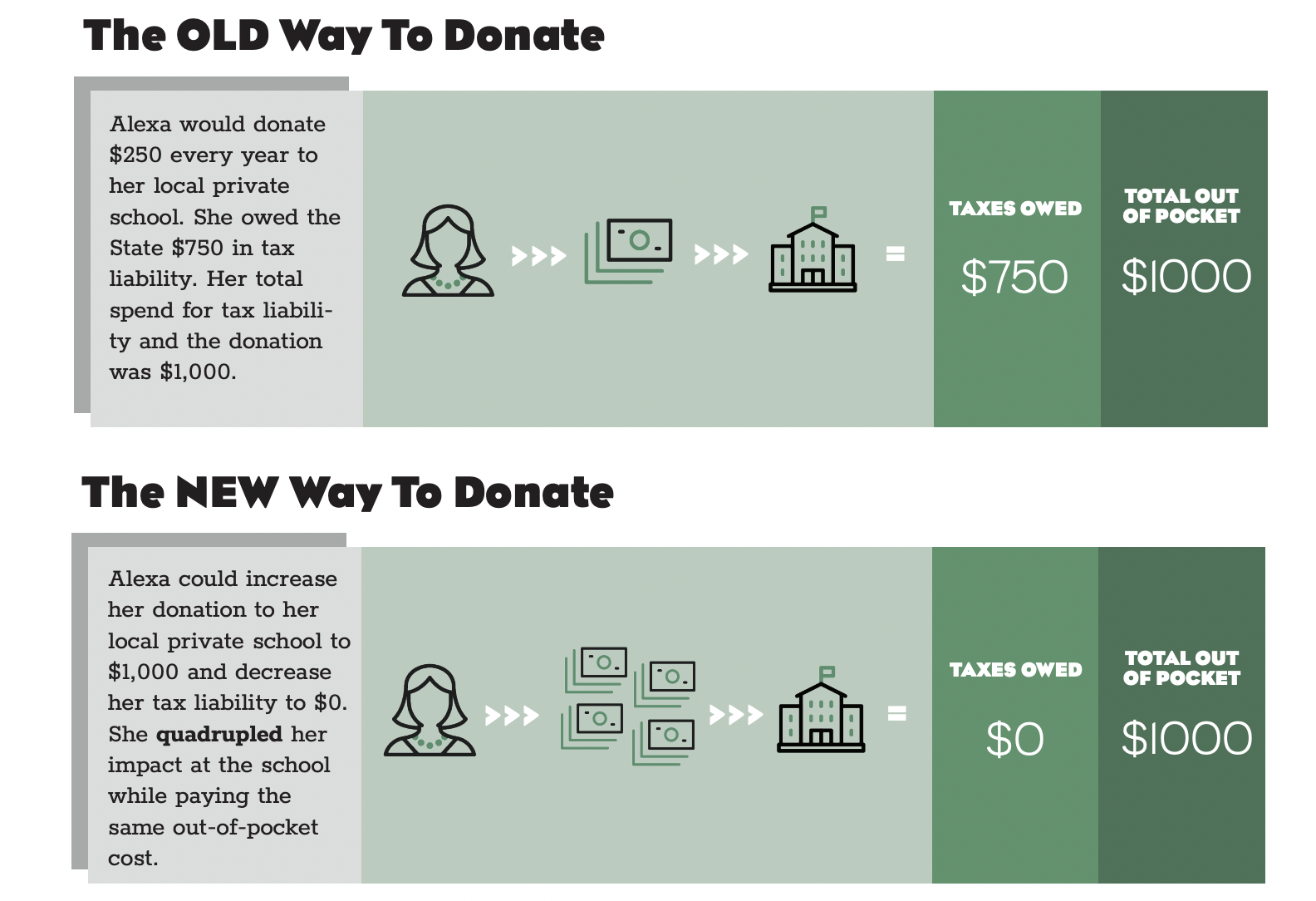

The Invest in Kids Act Tax Credit Scholarship (TCS) Program offers need-based scholarships to Illinois kids and offers a 75% Illinois state income tax credit to individuals and businesses that contribute to these scholarships through a qualified Scholarship Granting Organization, like Empower Illinois. Therefore, you can reduce or eliminate your Illinois income tax liability by making a donation to Empower Illinois and directing your tax dollars to the K-12 private school of your choice.

Empower Illinois’ new Donation Calculator estimates your annual state tax liability and the donation you could make to support tax credit scholarships in order to reduce or eliminate your Illinois income tax liability. All you have to do is enter your estimated annual income and the tool will automatically calculate the TCS donation amount that will redirect your entire state tax liability to student scholarships.

Donations to Empower Illinois are eligible for a 75% Illinois state income tax credit. Therefore, the out-of-pocket cost of your TCS donation is only 25%, while your gift for Illinois students is four times greater than the out-of-pocket cost.

These gifts support K-12 education scholarships and further Empower Illinois’ mission of making quality education accessible to low-income and working-class families across the state. Direct your tax dollars to students at the school of your choice and maximize the impact of your gift by donating today.

Please note, the information provided here was accurate at the time of creation, and is intended to be informative and educational, not to be mistaken as legal, accounting, or tax advice. The description and examples provided are for illustrative purposes only and should not be used as the sole example.